GOP Rift Deepens Over Clean Energy Tax Credits Fight | Image Source: www.grandforksherald.com

WASHINGTON, D.C., 11 April 2025 – The fight for the clean energy tax credits of the Inflation Reduction Act (IRA) is heating up in Capitol Hill, dividing Republican legislators and establishing a sharp line between ideological extremists and pragmatic conservatives. While some advocate a large-scale repeal of Biden’s green subsidies, others advocate a more measured and strategic approach that preserves the essential incentives for US energy investments, rural economies and business security.

The debate takes place when Congress is preparing to draft a reconciliation bill to eliminate federal spending. With a 53-47 Republican majority in the Senate, leadership has little room for desertion. However, according to a letter sent on Wednesday by four GOP senators, the party is increasingly concerned about the elimination of energy provisions in the IRA, which claims to have stimulated economic activity, reduced consumer accounts and encouraged investment in key sectors such as biofuels, carbon capture and advanced manufacturing.

Why are Republicans divided into IRA tax credits? The division is based on contrasting views on how incentives to clean energy are aligned with conservative principles. On the one hand, hard-line tax conservatives, like the House’s Freedom Caucus, view the IRA as a symbol of excessive democratic spending and climate survival. On the other hand, a growing group of GOP legislators – particularly those from energy-rich and agricultural states – consider targeted tax credits to be economically indispensable. According to Don Bacon (R-Neb.), the repeal of biofuel incentives could alienate Midwest legislators whose districts directly benefit from renewable fuel subsidies. “You can enter with a scalpel, but you will not get [everything] Republican vote if you want to get everything out,” Bacon said in an interview.

Senator John Curtis (R-Utah), who co-authorized the Senate letter, stressed the need to reflect on bias. ”What they say is, “Don’t just wear a party hat,” he said. “We’re going to put on a hat that’s the best for the country.”

Curtis, along with Sens. Lisa Murkowski (R-Alaska), Thom Tillis (R-N.C.), and Jerry Moran (R-Kan.), urged caution before dismantling measures that have already spurred meaningful U.S. investments.

Political and economic situation after reconciliation

The reconciliation process allows the Congress to pass budget-related laws by a simple majority, exceeding the challenge facing the Senate. Since the Republicans in the House and Senate have nothing to do with the details of the bill, they are faced with a strategic dilemma: reducing spending without alienating voters and industries that depend on the incentives supported by the IRA. The leader of most of the houses Steve Scalise (R-La.) acknowledged this act of balance, stating: “There are still many great battles ahead, and each one of them is important to have. »

Although Scalise has restored the idea of drawing “red lines”, it is clear that some factions have already done so. Rural Republicans, especially those in states where investments in biofuels, wind or solar energy are important, draw limits. In fact, 21 House Republicans signed a separate letter in March calling for a “random” approach to exemptions. The representative of Bacon pointed out that any effort to repeal tax credits on biofuels would face strong resistance. “You’re not going to have us vote to take this off,” he said.

What impact would it have on revoking these credits? Several stakeholders argue that the sudden elimination of ERI credits would lead to adverse uncertainty in the energy sector. Representative Mike Levin (D-Calif.), co-chair of the House Sustainable Energy and Environment Coalition, noted that clean energy developers base the project’s sustainability on predictable fiscal policies. “We must ensure the predictability and stability of project proponents,” he said. “Removing this certainty will be very bad.”

Senator Tillis echoed this feeling, saying that energy transition companies are already facing significant uncertainties. “With all the other uncertainties, we do not want to send a shock to the companies that have invested in this space. “

he said. For investors and manufacturers, tax incentives tied to clean energy provide the predictability needed to greenlight long-term projects.

The business hall is back

This week, industry players went down to Capitol Hill, stepping up lobbying efforts to preserve tax incentives. These companies, many of which have committed billions of dollars on the assumption that IRA credits would remain intact, argue that political investment would not be merely worrying, but would be devastating.

Although the Republican leadership has not yet specified which IRA programs are intended to reduce, inmates mention that provisions such as “transferability” – which allows the sale of tax credits to third parties – may be among the most vulnerable. The removal of this mechanism could significantly impede the financing of clean energy projects, in particular by startups and small players who depend on liquid markets for tax benefits.

Is there room for engagement? According to Senator Todd Young (R-Ind.), the final result will probably be half-negotiated. ”I think there will probably be a balance between elimination on the one hand and total preservation on the other,” he said. However, this means that there is a lot of complexity. Republican legislators must navigate between calming their base and preserving the economic benefits of the IRA.

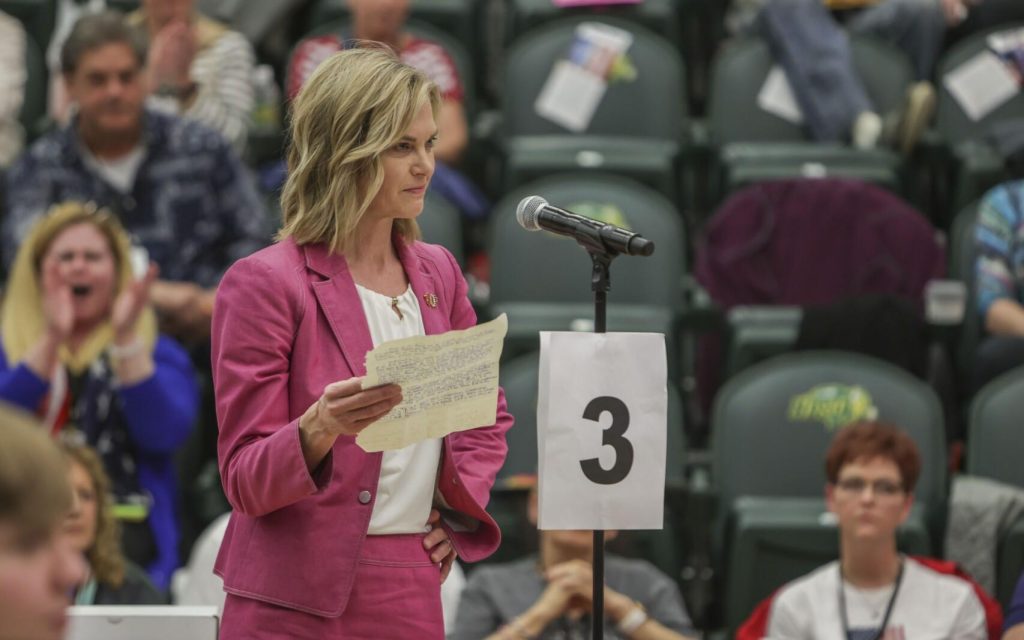

Julie Fedorchak’s Challenge for Clean Energy

Representative Julie Fedorchak (R-N.D.) added another ride to the debate. With the recent introduction of the Intermittent Energy Subsidies Act, Fedorchak seeks to eliminate tax credits for wind and solar energy over the next five years. Their argument is based on the belief that these subsidies survived their usefulness and distorted market signals. “These are very generous grants. They have been extremely effective”

Fedorchak told the Grand Forks Herald. “Quite frankly, they aren’t needed anymore.”

Fedorchak calls for a change in “dispatched” energy sources such as coal, gas and nuclear, especially when North Dakota is positioned as a potential AI-led data centre, which requires stable, large-scale energy supplies. Its position reflects broader concerns about network reliability and dependence on intermittent renewable energy. However, he stated that his legislation would not affect existing projects and continues to support tax credits for battery storage innovation.

Rebellion of the Agricultural State: Biofuels in the core

The strongest resistance to the repeal of the IRA tax credits can come from the Middle West, where biofuels are not just a source of energy, but an economic lifeline. Farmers and ethanol producers in states such as Iowa, Nebraska and Kansas have long relied on federal support to maintain their competitiveness. This unit became political in 2023 when the Iowa delegation managed to protect biofuels during the suspension of the Assembly’s debt ceiling. Now, a similar coalition pushes to preserve these credits in reconciliation.

This week, a bipartite group of legislators reintroduced the First Farmer Fuel Incentives Act, which would extend the 45Z Clean Fuel Tax Credit by limiting eligibility for US-funded raw materials. This measure is intended to protect domestic producers from foreign dependence. Sponsored by Reps. Marcy Kaptur (D-Ohio) and Tracey Mann (R-Khan.), and the Sens. Amy Klobuchar (D-Min.) and Roger Marshall (R-Khan.), the bill shows that high-risk rural legislators are committed to biofuels subsidies.

How does Trump influence the equation? Former President Donald Trump, whose influence on the GOP remains substantial, spoke out against the IRA. However, its precise position on the details of the derogation is unclear. Rep. Bacon reportedly faced Trump at two recent meetings, warning that firing the mayor of the IRA would break Republican unity. So far, the White House has not commented on the fine impression of the reconciliation strategy, allowing legislators to deal with it independently.

However, Trump’s commercial and energy positions remain influential. Representative Fedorchak expressed continued support for Trump’s tariffs, even when some companies expressed concerns about their impact. Its objective remains to ensure energy readiness for industrial needs, particularly for AI-related industries seeking to develop data centres in North Dakota.

“We have a great opportunity to be one of the solutions to AI’s energy needs, and I hope we will benefit from it,” said Ms. Fedorchak.

Ultimately, as the Republicans begin discussions at committee level, the outcome of the reconciliation bill will depend on the party’s ability to reconcile internal divisions. The tension between ideological purity and pragmatic governance has rarely been more visible, and the result will set the tone not only for energy policy, but also for the 2025 legislative programme in general.